In the wild west of cryptocurrency, where a single tweet can send markets soaring or crashing, ignoring the power of social media is a dangerous game.

Welcome to Lesson 7.5 of Walbi Academy, where we dive deep into sentiment analysis and monitoring social media. We're not just going to listen to the buzz; we're going to decode it, turning the chaotic chatter into actionable trading insights.

The Power of Social Media in Crypto: More Than Just Noise

Unlike traditional markets, the crypto space thrives on community and online discourse. Platforms like X, Reddit, and Telegram are the virtual town squares where trends are born, narratives are shaped, and fortunes are won or lost. Understanding this digital ecosystem is crucial.

- Identifying Emerging Trends: Social media is a breeding ground for emerging trends. Before they hit mainstream news, they're often discussed in online forums and chat groups. By monitoring these platforms, you can spot potential market movers early.

- Analyzing Community Sentiment: The collective mood of the crypto community can significantly impact price movements. A surge in positive sentiment can fuel a rally, while widespread fear can trigger a sell-off.

- The Influence of Key Figures: Influencers and thought leaders can sway market sentiment with pronouncements. Keeping track of their opinions and predictions is essential.

Remember the Dogecoin frenzy? A series of tweets from a certain billionaire sent its price skyrocketing. That's the power of social media in crypto. Understanding how to interpret this "buzz" is key.

Utilizing NLP for Sentiment Analysis: Turning Words into Data

To truly harness the power of social media, we need to go beyond simply reading posts. This is where Natural Language Processing (NLP) comes in. NLP algorithms analyze textual data, identifying patterns and extracting sentiment. They can tell you whether a tweet is positive, negative, or neutral.

- How NLP Works: NLP algorithms break down text into smaller units, analyze their meaning, and assign a sentiment score. This allows you to quantify the overall mood of a conversation.

- Challenges in Crypto Language: Crypto slang, memes, and sarcasm can be tricky for NLP algorithms to interpret. However, advancements in AI are constantly improving their accuracy.

- Tools and Techniques: Several tools and techniques are available for NLP-based sentiment analysis, from simple keyword analysis to complex machine learning models.

Imagine using an NLP tool to analyze thousands of tweets about a specific cryptocurrency. You can quickly see whether the overall sentiment is bullish or bearish, giving you a valuable edge in your trading decisions.

Integrating Social Media Data with Walbi: Your AI-Powered Sentiment Trading Hub

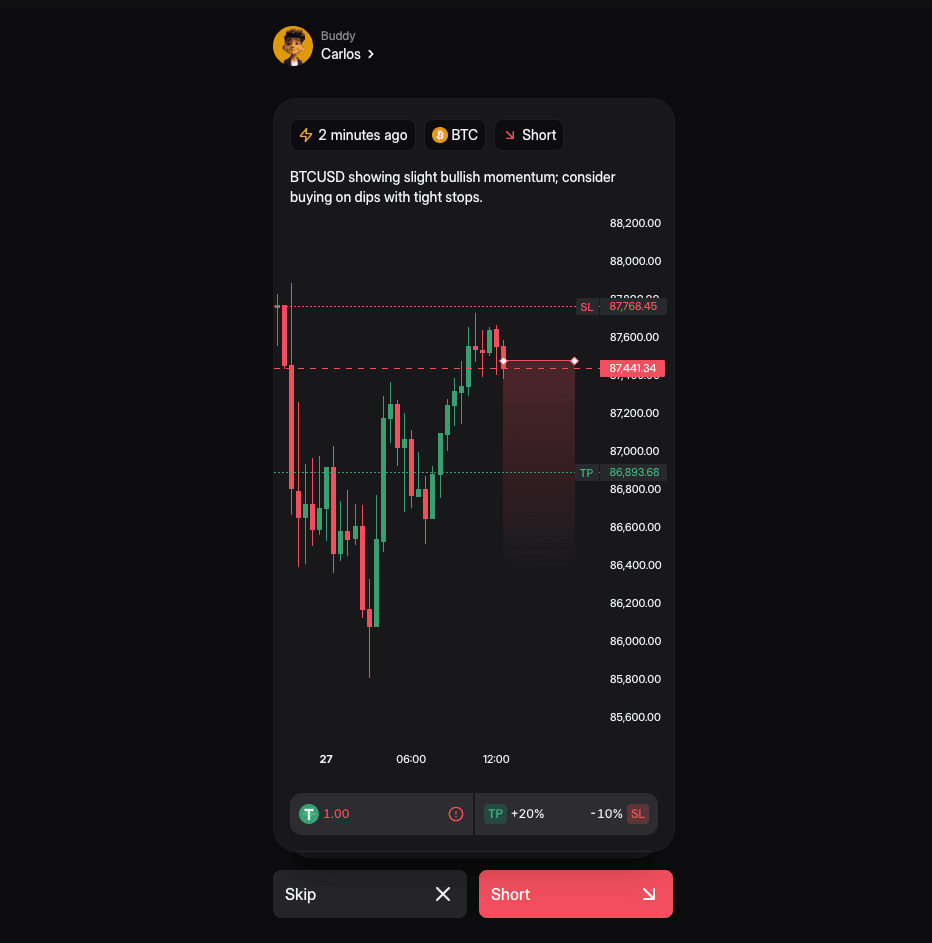

Walbi takes sentiment analysis to the next level by leveraging cutting-edge AI to scan and analyze vast streams of social media data in real-time. This allows you to go beyond manual tracking and tap into AI-driven insights directly within your trading workflow. Walbi's AI algorithms sift through the noise, extracting relevant sentiment signals and identifying emerging trends that might otherwise go unnoticed.

By providing you with these AI-powered insights, Walbi helps you make more informed trading decisions, giving you an edge in the fast-paced crypto market. You can then use Walbi’s charting tools to match the sentiment with possible entries and exits. This direct integration of AI-driven sentiment analysis into your Walbi trading experience allows you to react quickly to market shifts and capitalize on opportunities as they arise, all within one powerful platform.

Practical Application: Building a Sentiment-Driven Trading Strategy

Let's build a practical example. Imagine you're trading a newly listed token. You notice a surge in positive sentiment on X, with influencers and community members expressing excitement.

Here's your strategy:

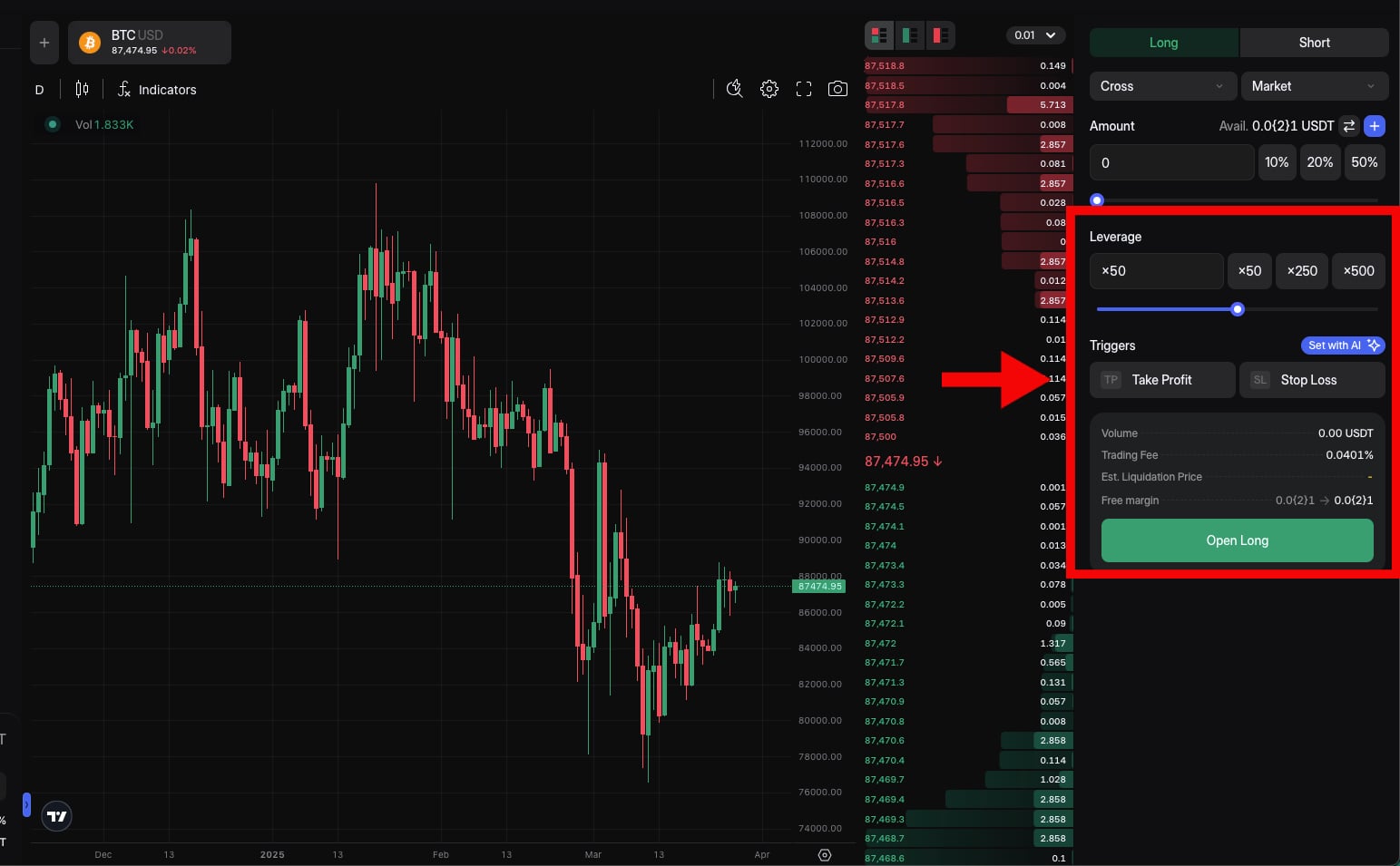

- Confirm with Other Indicators: Don't jump in blindly. Confirm the positive sentiment with technical indicators on Walbi, such as volume and price action.

- Set Entry and Exit Points: Use Walbi's charting tools to identify potential entry and exit points based on technical analysis.

- Manage Risk: Set stop-loss and take profit orders to limit potential losses if the sentiment-driven rally fizzles out.

Remember, sentiment can change rapidly. Always manage your risk and avoid emotional trading.

The Future of Sentiment-Informed Trading: Stay Ahead of the Curve

The crypto market is constantly evolving, and sentiment analysis is becoming increasingly important. By mastering this skill, you can gain a significant edge over other traders.

Walbi Academy is committed to providing you with the tools and knowledge you need to succeed. Explore the world of sentiment analysis, experiment with different strategies, and share your insights with the Walbi community. The future of trading is sentiment-informed, and you're well on your way to mastering it!