Ever feel like you're trading in the dark? Like you're missing a crucial piece of the puzzle? Well, what if I told you there's a way to see inside the blockchain itself? That's right, we're talking about on-chain analysis, and it's about to revolutionize your trading game. Welcome to Lesson 7.4 of Walbi Academy, where we're going to unlock the secrets hidden within the blockchain and turn you into a data-driven trading ninja!

The Power of On-Chain Data: Beyond the Price Charts

Forget relying solely on price charts and social media buzz. On-chain analysis lets you peek directly into the blockchain's activity, revealing valuable insights that traditional analysis simply can't provide. It's like having X-ray vision for the crypto market. By understanding how transactions flow, how many addresses are active, and what the big players (whales!) are doing, you can gain a significant edge over other traders. We're not just talking about predicting price movements; we're talking about understanding the why behind those movements.

Understanding Key On-Chain Metrics: Deciphering the Blockchain's Language

To truly harness the power of on-chain analysis, you need to speak the blockchain's language. Let's break down some key terms:

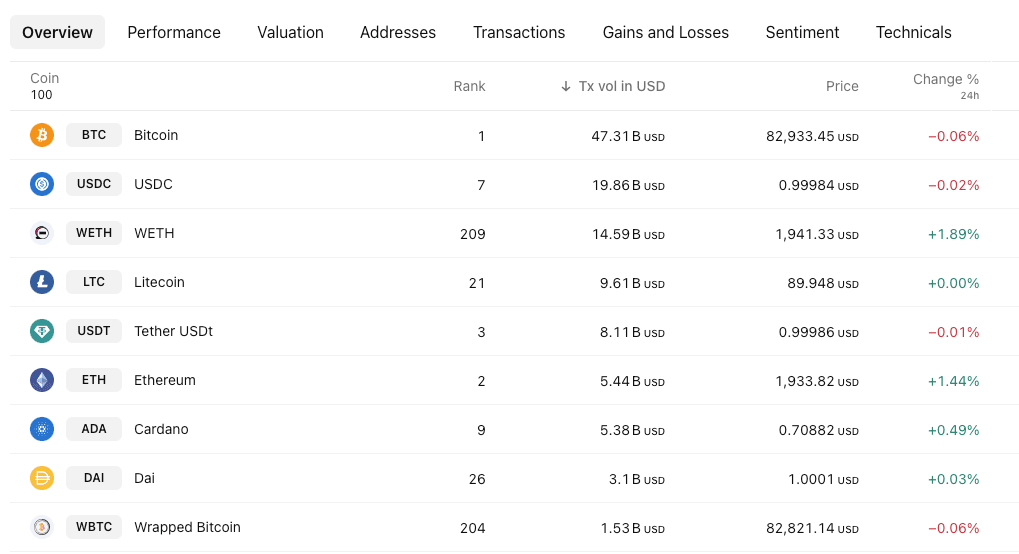

- Transaction Volume: This tells you how much activity is happening on the blockchain. A surge in transaction volume can indicate increased interest and potential price volatility. Conversely, low volume might suggest a lack of enthusiasm. Imagine a busy market versus a ghost town – volume tells you which one you're in.

- Active Addresses: These are the unique addresses participating in transactions. A rise in active addresses signals growing network adoption and potential price appreciation. Think of it as the number of people visiting a popular website – more visitors, more activity.

- Whale Activity: These are large transactions made by big players (whales). Tracking their movements can reveal their sentiment and potential market-moving actions. When whales move, everyone notices.

These metrics aren't just numbers; they're stories. They tell you about the network's health, the adoption level, and the potential for future growth.

Leveraging On-Chain Data for Market Analysis: Seeing the Future in the Present

Now, let's put these metrics to work. On-chain data allows you to identify trends and potential reversals before they become obvious on price charts. For example, a sudden spike in active addresses coupled with rising transaction volume could signal a breakout. Or, a large outflow of funds from exchanges might indicate whales are accumulating, hinting at a potential price surge.

Imagine this: You notice a significant increase in whale activity, with large amounts of Bitcoin moving from exchanges to cold wallets. This could suggest that whales are anticipating a price increase and are accumulating before the market catches on. This gives you a window of opportunity to position yourself for potential gains.

Remember, on-chain analysis isn't a crystal ball, but it does give you a clearer picture of market dynamics. Combining it with technical and fundamental analysis can significantly improve your trading accuracy.

Harnessing On-Chain Insights with Walbi's Trading Tools

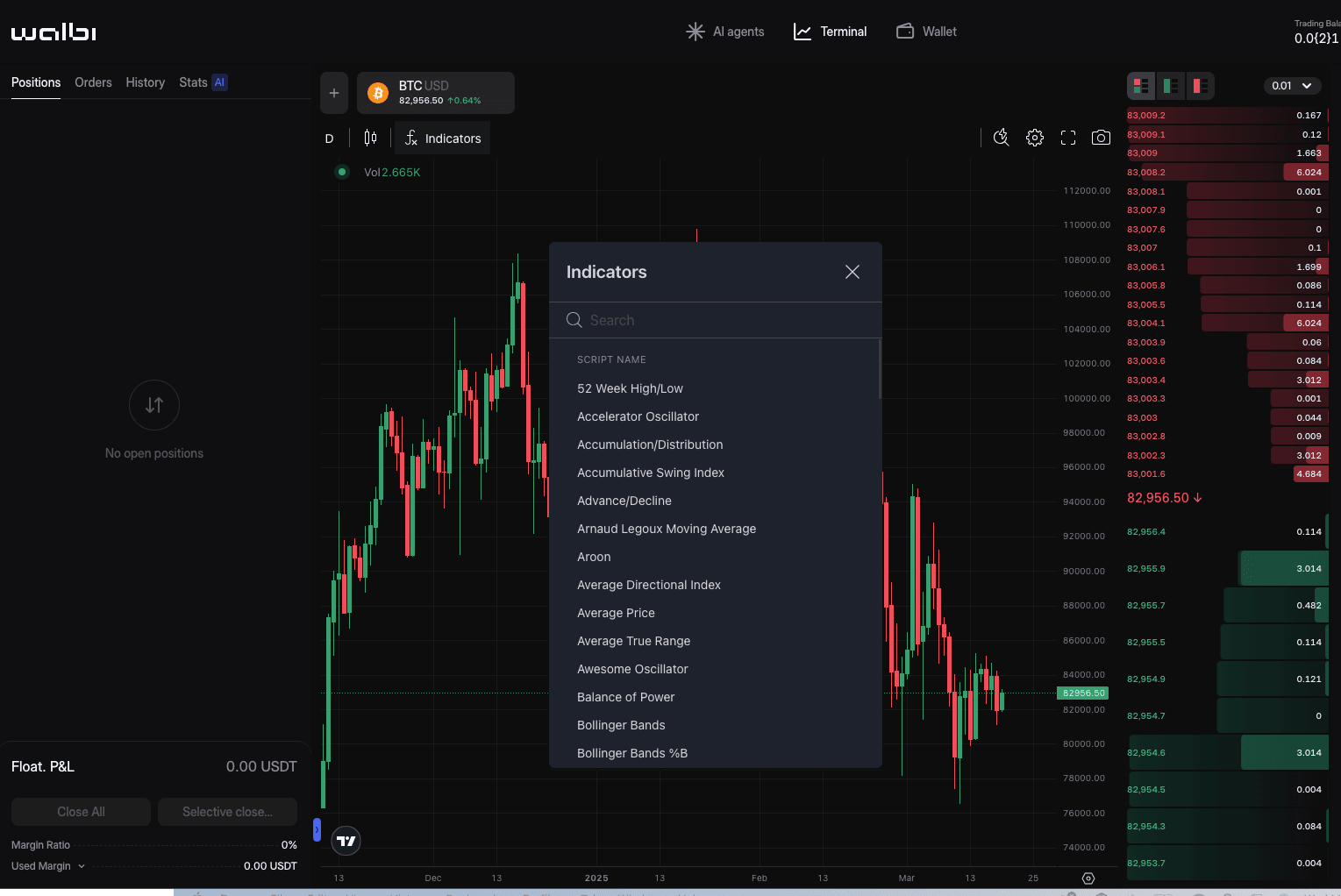

While Walbi provides a robust trading platform, you can enhance your strategies by integrating insights gained from external on-chain analysis tools. By utilizing resources that offer real-time data on transaction volume, active addresses, and whale activity, you can layer valuable context onto your trading decisions. Here's how to effectively use on-chain analysis in tandem with Walbi's features:

First, conduct your on-chain research using dedicated platforms and data providers. Then, apply those insights to your trading strategy within Walbi. For example, if on-chain data indicates a surge in active addresses, you might look for corresponding price movements on Walbi's charts. You can use Walbi's charting tools to identify potential entry and exit points that align with your on-chain analysis. By combining these external data points with Walbi's trading functionalities, you can make more informed and strategic trading decisions.

Practical Application: Building a Data-Driven Trading Strategy

Let's build a simple trading strategy using on-chain data. Imagine you're trading Ethereum. You notice a consistent increase in daily active addresses and transaction volume, suggesting growing network adoption. You also observe whales accumulating ETH in their wallets.

Here's your strategy:

- Set a buy order when the daily active addresses reach a new all-time high.

- Place a stop-loss order below a key support level to manage risk.

- Set a take-profit order based on a combination of technical analysis and on-chain indicators.

Remember, risk management is crucial. Don't put all your eggs in one basket. Diversify your portfolio and use stop-loss orders to limit potential losses.

Try Cross Margin Trading on Walbi

Now, imagine combining the power of on-chain analysis with the flexibility of Walbi's new Cross Margin Trading feature. By leveraging on-chain data to identify potential market movements, you can confidently open positions with the added security of cross-margin. For instance, if your on-chain analysis indicates a potential breakout, you can utilize cross margin to maximize your position size while mitigating the risk of liquidation during short-term volatility.

This feature allows you to capitalize on data-driven insights with greater confidence, knowing that your entire account balance is working to protect your trades. By integrating on-chain analysis with Walbi's Cross Margin Trading, you can take your trading strategy to the next level, leveraging the power of data and flexibility to navigate the crypto market with greater precision and control."

Embracing the Power of Blockchain Data: Your Journey Continues

Congratulations! We've just scratched the surface of on-chain analysis. There's a whole world of blockchain data waiting to be explored. Keep learning, keep experimenting, and keep adapting. The crypto market is dynamic, and your ability to leverage data will be your greatest asset.

Walbi Academy is here to support you on your journey. Join us next week for another exciting lesson!