If you've ever felt the gut-wrenching pang of a liquidation notice, watching your hard-earned funds vanish because a single trade veered off course, you're not alone. We've all been there, navigating the turbulent waters of crypto trading. But now, a powerful tool has arrived to offer a lifeline: cross-margin trading.

This feature promises to inject more flexibility into your trading strategy, extending your lifespan in the market and mitigating the dreaded liquidation risk.

What’s the Deal with Cross-Margin Trading?

To understand the beauty of cross margin, let's contrast it with its predecessor, isolated margin. Each trading position operates independently in an isolated margin, with its own allocated margin. If a trade moves against you, only the margin assigned to that specific position is at risk. Conversely, cross-margin adopts a holistic approach, pooling all your available funds into a single margin balance. This means that if one position encounters turbulence, the remaining balance in your account acts as a safety net, cushioning the blow and significantly reducing the likelihood of liquidation.

A Practical Example:

Imagine you have 1,000 USDT in your trading account. You decide to open two positions: one for 500 USDT and another for 300 USDT. With an isolated margin, each position would be evaluated separately. If the 500 USDT trade moves against you and hits its liquidation price, it's gone, regardless of the 200 USDT still in your account. However, with cross margin, all 1,000 USDT are considered.

If the 500 USDT trade starts to falter, the remaining 500 USDT balance acts as a buffer, preventing immediate liquidation. This ensures that your idle funds are actively working to protect your overall portfolio, rather than passively sitting by.

This fundamental shift in margin management empowers traders to adopt more dynamic strategies, knowing that their entire account balance is working in unison to safeguard their positions. It's a game-changer for those who have experienced the frustration of watching a position get liquidated while unused funds remain untouched.

Cross-Margin Trading: Why Should You Care?

The implications of cross-margin extend far beyond simply avoiding liquidation. It offers several advantages that can significantly enhance your trading experience.

- More Room to Breathe:

- With cross margin, your entire account balance acts as a unified margin, providing a substantial buffer against market volatility. This allows you to withstand temporary price fluctuations without the constant fear of immediate liquidation. You gain the freedom to let your trades play out, giving them the necessary time to recover.

- With cross margin, your entire account balance acts as a unified margin, providing a substantial buffer against market volatility. This allows you to withstand temporary price fluctuations without the constant fear of immediate liquidation. You gain the freedom to let your trades play out, giving them the necessary time to recover.

- Lower Liquidation Risk:

- The pooling of your funds reduces the risk of liquidation Even if one trade experiences a significant drawdown, the remaining balance can absorb the impact, preventing a complete wipeout. This is particularly beneficial in volatile markets where sudden price swings can trigger liquidations under isolated margin.

- The pooling of your funds reduces the risk of liquidation Even if one trade experiences a significant drawdown, the remaining balance can absorb the impact, preventing a complete wipeout. This is particularly beneficial in volatile markets where sudden price swings can trigger liquidations under isolated margin.

- Capital Efficiency:

- Cross margin eliminates the need to manage individual trade margins. You no longer have to worry about setting precise amounts of margin to each position. Instead, your entire balance is automatically utilized, maximizing your capital efficiency. This streamlined approach frees up your time and mental energy, allowing you to focus on developing and executing your trading strategies.

- Cross margin eliminates the need to manage individual trade margins. You no longer have to worry about setting precise amounts of margin to each position. Instead, your entire balance is automatically utilized, maximizing your capital efficiency. This streamlined approach frees up your time and mental energy, allowing you to focus on developing and executing your trading strategies.

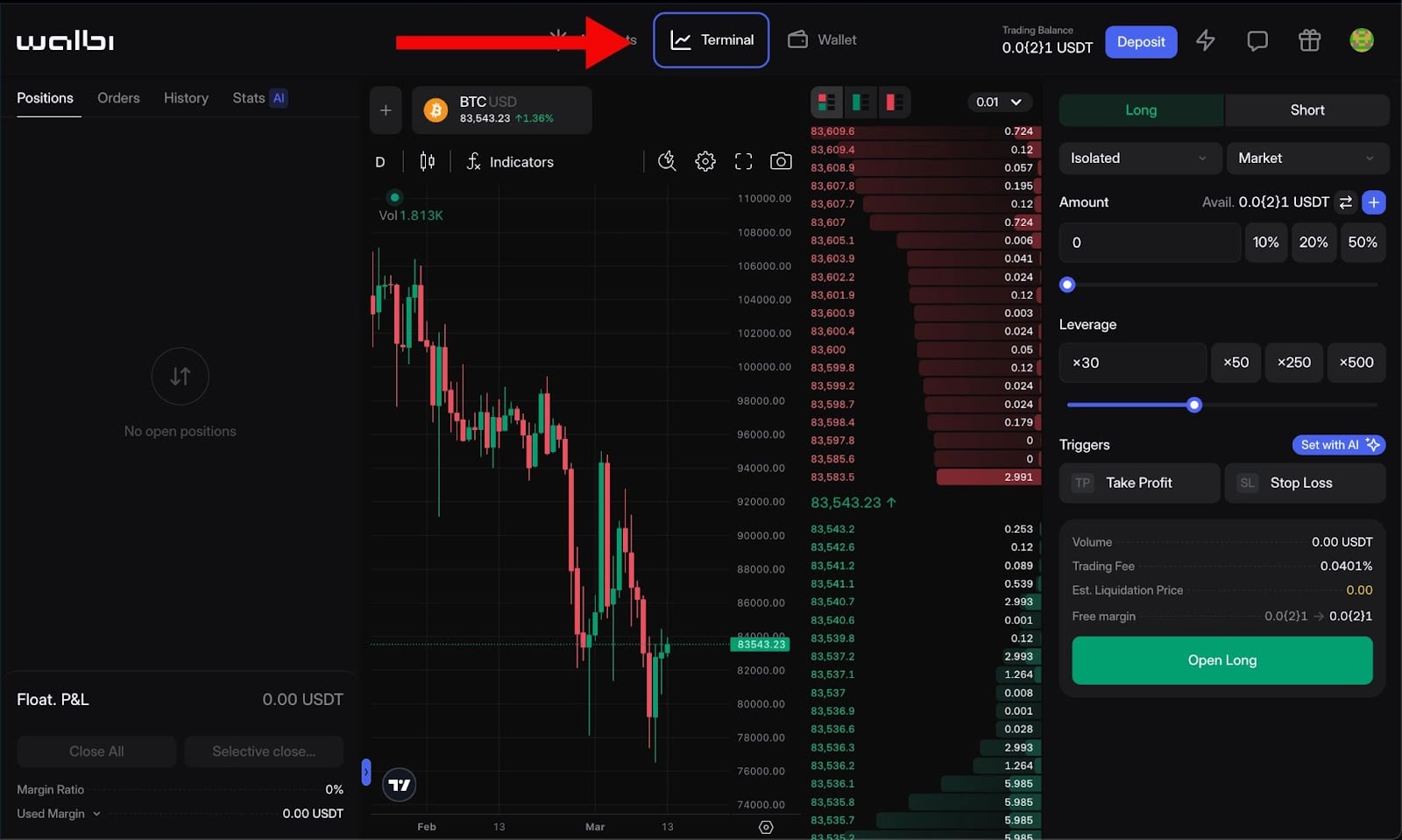

How to Switch to Cross Margin on Walbi

Transitioning to cross margin on Walbi is a seamless process, designed to be user-friendly and accessible to traders of all experience levels.

- Go to the Terminal:

- Begin by navigating to the trading terminal on the Walbi platform. This is your central hub for all trading activities.

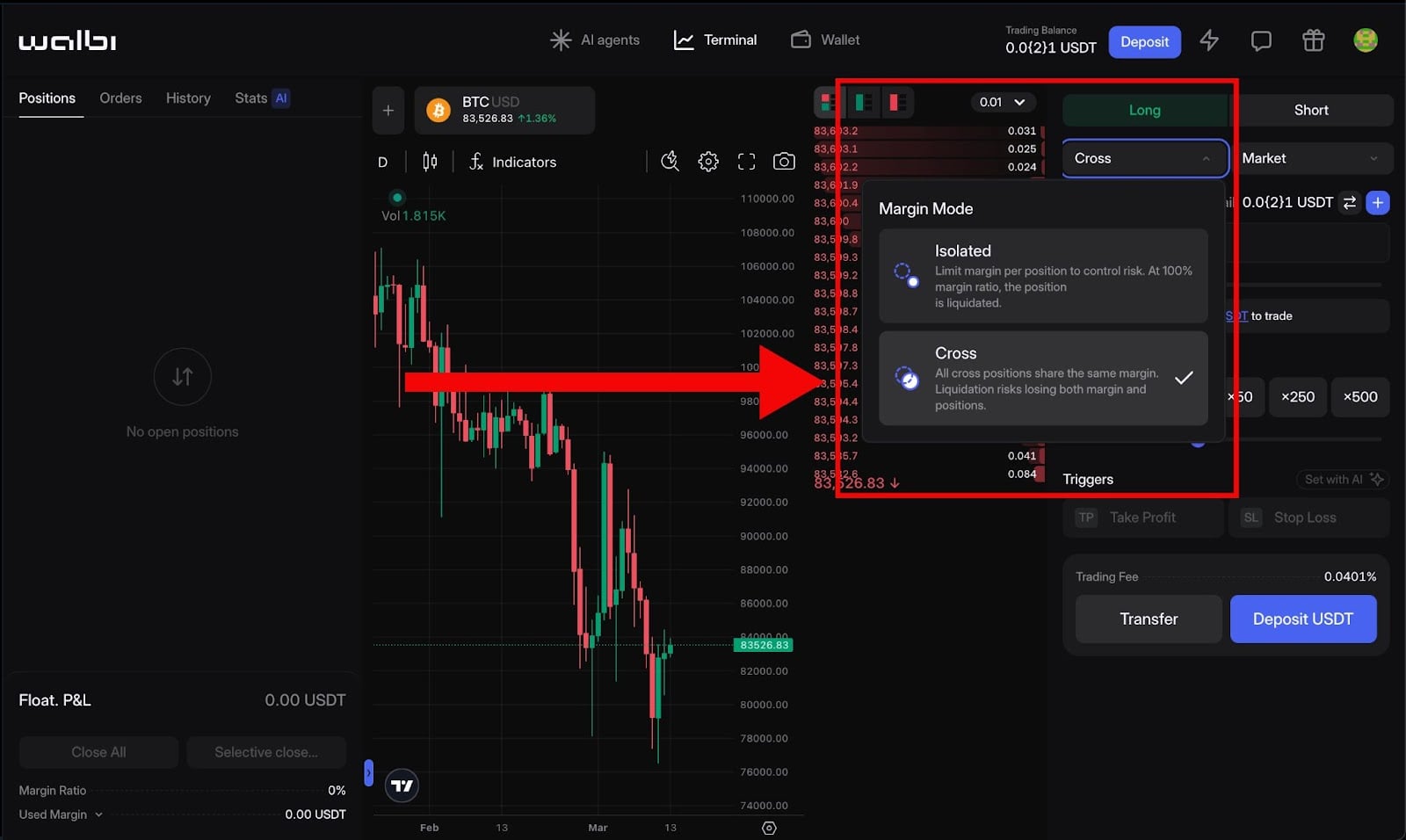

- Select Cross Margin in the Trade Form:

- Within the trade form, you'll find the option to choose between isolated and cross margin. Simply select the cross-margin option to activate this feature for your trades.

- Open a Trade:

- Proceed to open your desired trade, knowing that your entire account balance will now serve as the margin.

- Proceed to open your desired trade, knowing that your entire account balance will now serve as the margin.

- Keep an Eye on Your Risk Level:

- While cross margin provides a significant safety net, it's crucial to remember that it's not invincible. Continuously monitor your risk level, especially during periods of high volatility. Walbi provides real-time risk assessments, allowing you to stay informed and take proactive measures.

- While cross margin provides a significant safety net, it's crucial to remember that it's not invincible. Continuously monitor your risk level, especially during periods of high volatility. Walbi provides real-time risk assessments, allowing you to stay informed and take proactive measures.

Cross Margin Trading: Pros and Cons

While cross-margin offers numerous benefits, it's essential to approach it with a clear understanding of its potential risks.

- Bigger Gains? Maybe. Bigger Risks? Also Maybe:

- Cross-margin can amplify your potential gains by allowing you to open larger positions.6 However, it also magnifies your potential losses. It's crucial to exercise caution and avoid overleveraging your account.

- Cross-margin can amplify your potential gains by allowing you to open larger positions.6 However, it also magnifies your potential losses. It's crucial to exercise caution and avoid overleveraging your account.

- Keep Track of Your Liquidation Price:

- Even with cross margin, your positions can still be liquidated if your account balance falls below the required maintenance margin. Continuously monitor your liquidation price, especially in volatile markets, to avoid unexpected liquidations.

- Even with cross margin, your positions can still be liquidated if your account balance falls below the required maintenance margin. Continuously monitor your liquidation price, especially in volatile markets, to avoid unexpected liquidations.

- Know How Margin Lending Works Before Going All In:

- Margin lending is an advanced tool. Ensure you have a firm grasp of how it works before you employ it. Understand the fees, interest rates, and potential risks involved.

- Margin lending is an advanced tool. Ensure you have a firm grasp of how it works before you employ it. Understand the fees, interest rates, and potential risks involved.

The Walbi Advantage

Cross margin is now live on Walbi, empowering traders to navigate the crypto market with greater confidence and flexibility. The Walbi team has already integrated this feature into their trading strategies, and now it's your turn to experience its benefits firsthand.

Try It, Tweak Your Strategy, and See How It Fits Your Trading Style:

Embrace the opportunity to experiment with cross-margin and discover how it complements your trading approach. Start by incorporating it into your existing strategies, gradually increasing your position sizes as you become more comfortable. Continuously monitor your performance and make adjustments as needed.

Remember, cross margin is a powerful tool, but it's not a magic bullet. Success in crypto trading requires a combination of knowledge, discipline, and adaptability. By understanding the intricacies of cross-margin and integrating it into your trading arsenal, you can enhance your chances of achieving your financial goals.

The crypto market is a dynamic and ever-evolving landscape. Embrace the opportunities presented by innovative tools like cross-margin and continue to refine your trading skills. Your journey to becoming a successful crypto trader is a marathon, not a sprint.